Now that Elon Musk has proven that electric cars offer a serious business opportunity with the increasingly popular lineup of Tesla models, the rest of the automotive industry appears hot to trot. Musk's own Model S Chief Engineer Peter Rawlinson departed to open Lucid, which plans to sell the Air sedan at a price point competing with the Model S and Porsche's Taycan.

Meanwhile, established automakers have poured huge amounts of capital into other EV startups, like GM's on-again-off-again relationship with Nikola and Ford's half-billion-dollar investment in Rivian. But anytime a boom explodes on the scene, the potential for questionable activity amidst the rush also increases and now, the investment research company Hindenberg Research has levied some serious allegations of potential fraud against Lordstown Motors, the firm most famous for buying out GM's Ohio plant and attracting attention from former President Donald J. Trump.

CEO Steve Burns A "PT Barnum" Figure

Lordstown CEO Steve Burns features prominently in Hindenberg's report, which claims to have interviewed former coworkers from his previous position at Workhorse, a publicly traded company he also founded but was forced to leave in 2019. Shortly thereafter, Burns attracted investment and plenty of earned media by getting on Trump's good side after GM shuttered the Lordstown, Ohio, facility—to the dismay of the America-first mentality Trump continually espoused.

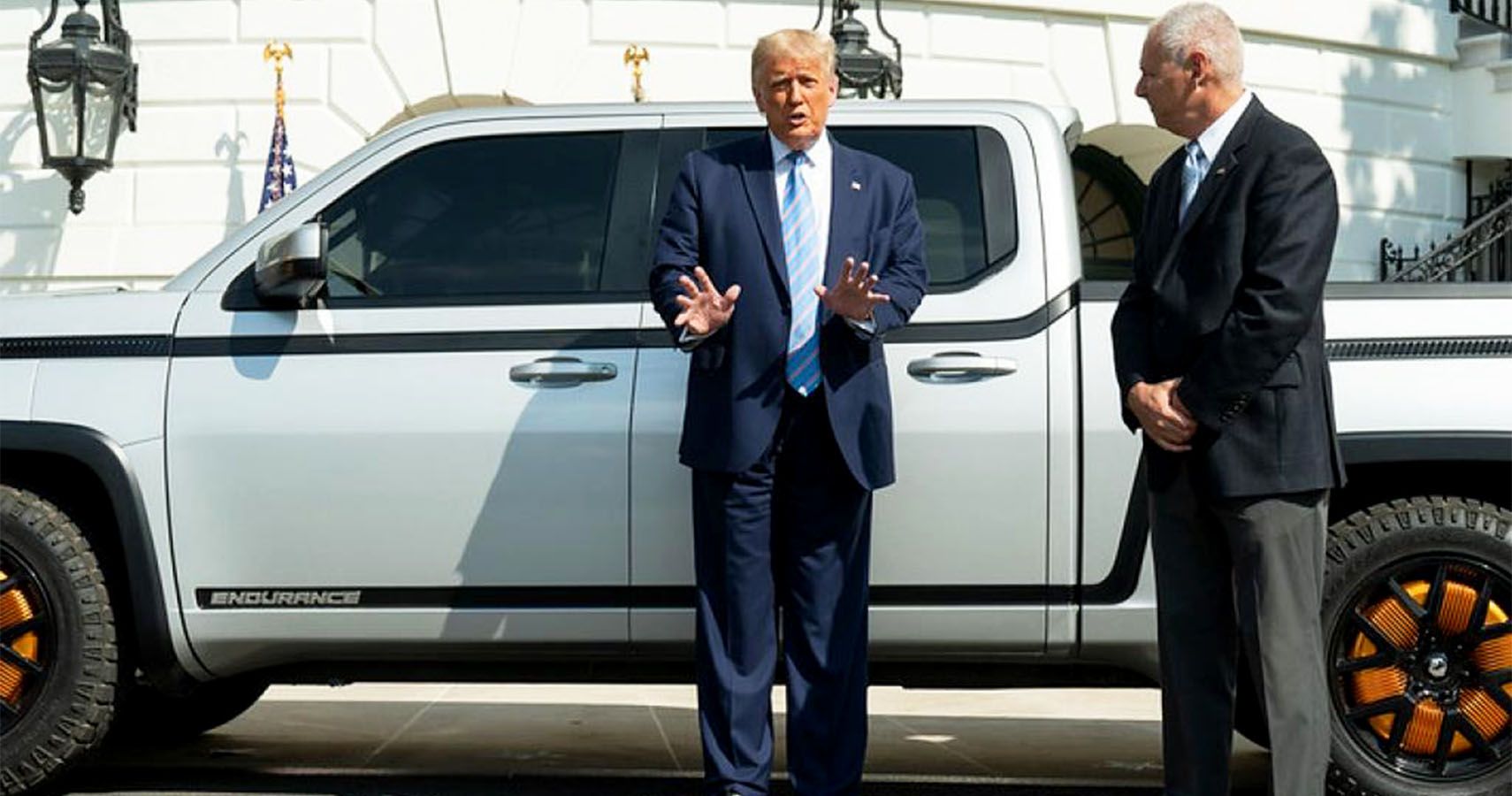

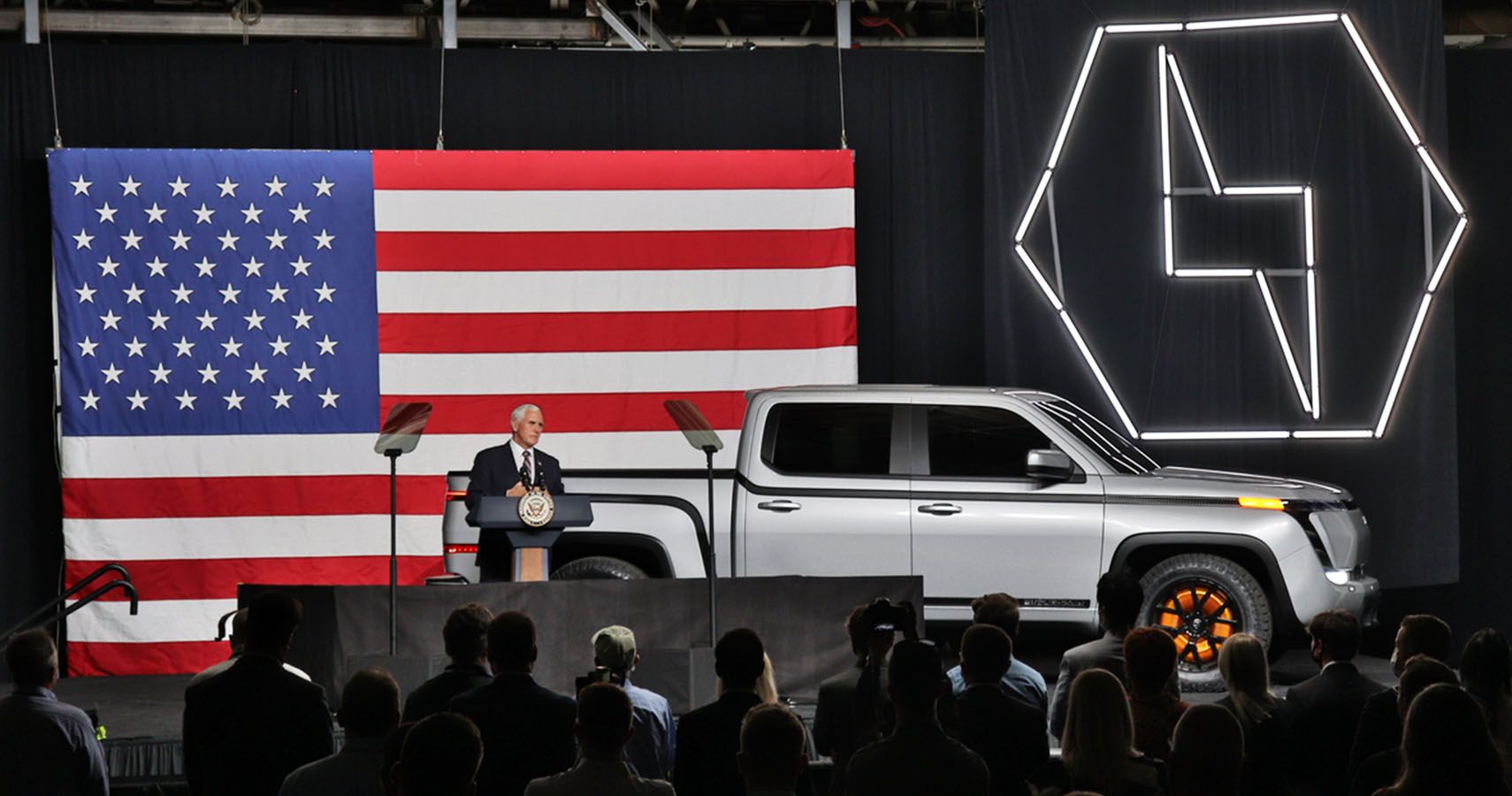

Borrowing its name from the town itself, Lordstown then went on to showcase the electric Endurance pickup truck at events featuring Trump, the White House, and Vice President Mike Pence. But Hindenberg claims that all the fanfare and explicit claims by Burns and Lordstown about successful pre-orders reaching into the six-figure range could all be an elaborate marketing ruse to raise more capital—all while Lordstown's electric pickup remains years away from production.

Lordstown's Response To The Allegations

The full extent of Hindenberg's claims seems well-documented and far too detailed to fully list here, but includes on-the-record interviews, official paperwork documenting the extensive use of a "Non-Binding Letter of Intent" for pre-orders that may or may not even have been placed by real companies. As one example, Lordstown recently announced a 14,000-truck deal from E Squared Energy, supposedly representing $735 million in sales. The problem is that E Squared's address is a small residential apartment in Texas and doesn’t operate a vehicle fleet. There is also the simple fact that what might have been Lordstown's only running prototype caught fire only 10 minutes into its first test drive.

For his part, Burns responded to the allegations in a Wall Street Journal interview. He highlight's the fact that Hindenberg's short position on Lordstown stock makes the report's timing seem a little questionable given that his company will release its first quarterly update as a publicly traded entity only next week.

Sources: hindenbergresearch.com and wsj.com.