While we would all love to be able to drive our dream cars as we wish, the fact is that there are a variety of constraints that limit and proscribe what we can drive, how we can drive them, and what is available.

These constraints come in a variety of shapes and sizes spanning the legal, political, and economic fields. If all of this seems a little confusing or too academic, simply consider differing laws on car exhausts, the availability or lack of certain brands, and petrol prices. Each of these areas is shaped by at least one of these categories and influences driving on a daily basis. So why does this matter? Why does this topic need to be discussed?

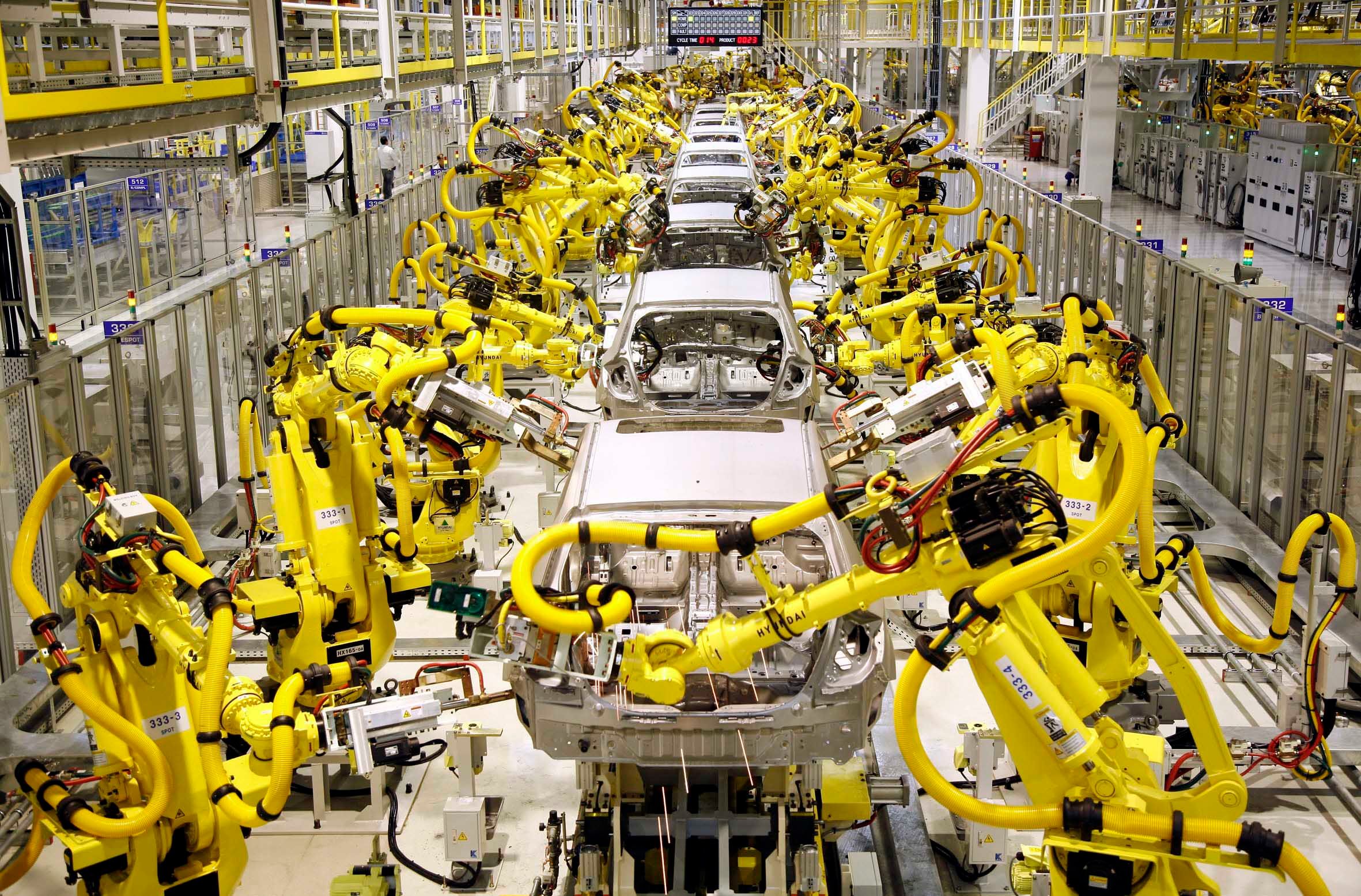

While it might be tempting to believe that the automotive industry revolves around horsepower, consumer demand, and profit, the reality is that the automotive industry is heavily shaped by the government and needs to consider a whole array of interests and legislation. With political pressure to turn our societies green, electric vehicle (EV) technology has developed so rapidly that the law is struggling to catch up, meaning that the relationships between interests, legislation, and cars are somewhat tense. More specifically, the US government has recently proposed a system of tax credit for consumers who purchase EVs, seeking to incentivize EVs and thus promote a 'greener society.'

The impacts of this legislation are very different depending on whether the manufacturers have a workers union or not, leading to outright discrimination against manufacturers who do not have such unions. Let's discuss why Toyota and Honda have been hit specifically hard by these proposed changes and why they are fighting against these changes.

A Little Context For These Policy Proposals

Before this policy can be properly discussed, it is vital to understand the context that it seeks to speak to.

It is a well-known fact that the success of a government policy is dependent on various factors, one of the most significant ones being timing. So working on the causal assumption that this policy proposal was consciously introduced not long ago, the current automotive manufacturing market trends need to be understood in order to make sense of this proposal.

Alright, so what do we know? What does the automotive market look like?

Firstly, there is a general transition to EVs, with more and more manufacturers creating EVs. Just typing in EV into the search bar on this site wields 23 pages of results, with other car media platforms being very similar. Put it like this, it was just 13 years ago, in 2008, that Tesla launched their first model, the Tesla Roadster, to the public. Over the course of 13 years more and more manufacturers have gotten on board, ranging from affordable, everyday rides offered by Ford, Toyota and Honda, to the more elegant, more expensive offerings from Audi, BMW and Mercedes-Benz, going all the way to the ultra-luxurious, most expensive offerings from Aspark, Rimac, and Rolls-Royce.

Consequently, there is a general expectation that over the next couple of decades, more and more EVs will be sold and driven on American roads. Specific rates and figures for the 'EV takeover' are educated guesses at the best, however, some are claiming that by 2030, EV sales will make up 48% of passenger car sales. Furthermore, the Biden administration wishes to support this transition, looking to move away from the petrochemical industry as much as possible to protect the environment.

What Are These Proposed Changes?

Having established the context for the rising popularity of EVs, what does this proposed policy actually entail?

Basically, the changes entail a system of tax credit provided to the purchasers of EVs. Sounds pretty awesome right? Well, the thing is the tax credit given is dependent on the brand of the EV purchased, with unionized brands receiving an extra $4,500 on top of the other incentives. There would be a $7,500 base consumer tax rebate on an EV, with an extra $4,500 tax rebate if it's from a unionized brand. Additionally, there is an extra $500 tax rebate for cars that use batteries made in America.

These tax rebates would be in place for the first five years of buying a new EV, with the base $7,500 continuing for an extra 5 years if the vehicle is made in America. However, these rebates are only applicable for sedans retailing for less than $55,000, vans retailing for less than $64,000, SUVs retailing for less than $69,000 and pickups retailing for less than $74,000.

How Does This Affect Manufacturing And The Consumer?

Needless to say, this proposed policy will greatly benefit consumers purchasing a new EV, with benefits for American EV manufacturers, especially unionized manufacturers.

However, overseas manufacturers and non-unionized manufacturers would be placed at a significant disadvantage if this policy is implemented. This is why Toyota and Honda are avidly opposing this policy as their companies do not have unions in the US, Honda stating that this policy would "discriminate among EVs made by hard-working American auto workers based simply on whether they belong to a union."

Similarly, Toyota has added that it will "fight to focus taxpayer dollars on making all electrified vehicles accessible for American consumers who can’t afford high-priced cars and trucks." It is important to note that the discrimination experienced by this policy would not just be felt by Toyota and Honda as companies, but also their American workers and any consumer wishing to purchase a Toyota or Honda EV, especially considering that they offer some of the cheaper options.

Admittedly, the Democrats have a 220-212 majority in the House, and a slight 50-50 majority in the Senate, with Kamela Harris being the tie-breaker vote. But it remains too early to tell what will happen, so keep checking back to see the outcome.

Sources: HotCars, CarAndDriver, Tesla, GreenAuthority, AutoBlog, DetroitNews and Reuters