Cox Automotive is reporting that wholesale used-vehicle prices declined by 2.1% in February. The Manheim Used Vehicle Value Index declined in February to 231.3. That is still a 36.7% increase from a year ago. The non-adjusted price change in February was a decline of 2.2% compared to January. The adjusted average price of used cars is up 32.4% for the year.

Slow Start To Tax Season Is Causing Lower Demand For Used Cars

Cox's data indicates that the decrease in used car prices in February was the result of used retail sales dropping 7% from a year earlier. Some of that drop in demand is due to a slow start to this year's tax refund season. Cox estimates that only 17% of this year's tax refunds have gone out, which is far less than the 38% that went out by this time in 2019. Tax refunds are often used to buy preowned automobiles, and the average refund is up by 13% this year. Therefore, the used car market could see stronger demand as more taxpayers receive their refund checks from the Internal Revenue Service.

Used Car Prices Are Still Close To An All-Time High But Supply Is Growing

The average price of a used car reached an all-time high in January 2022. So, the average price in February is a slight decrease from that. But it was the first decline for used car prices in several months.

Price patterns varied by vehicle age and segment. Older vehicles saw greater price stability, and younger vehicles experienced larger price declines.

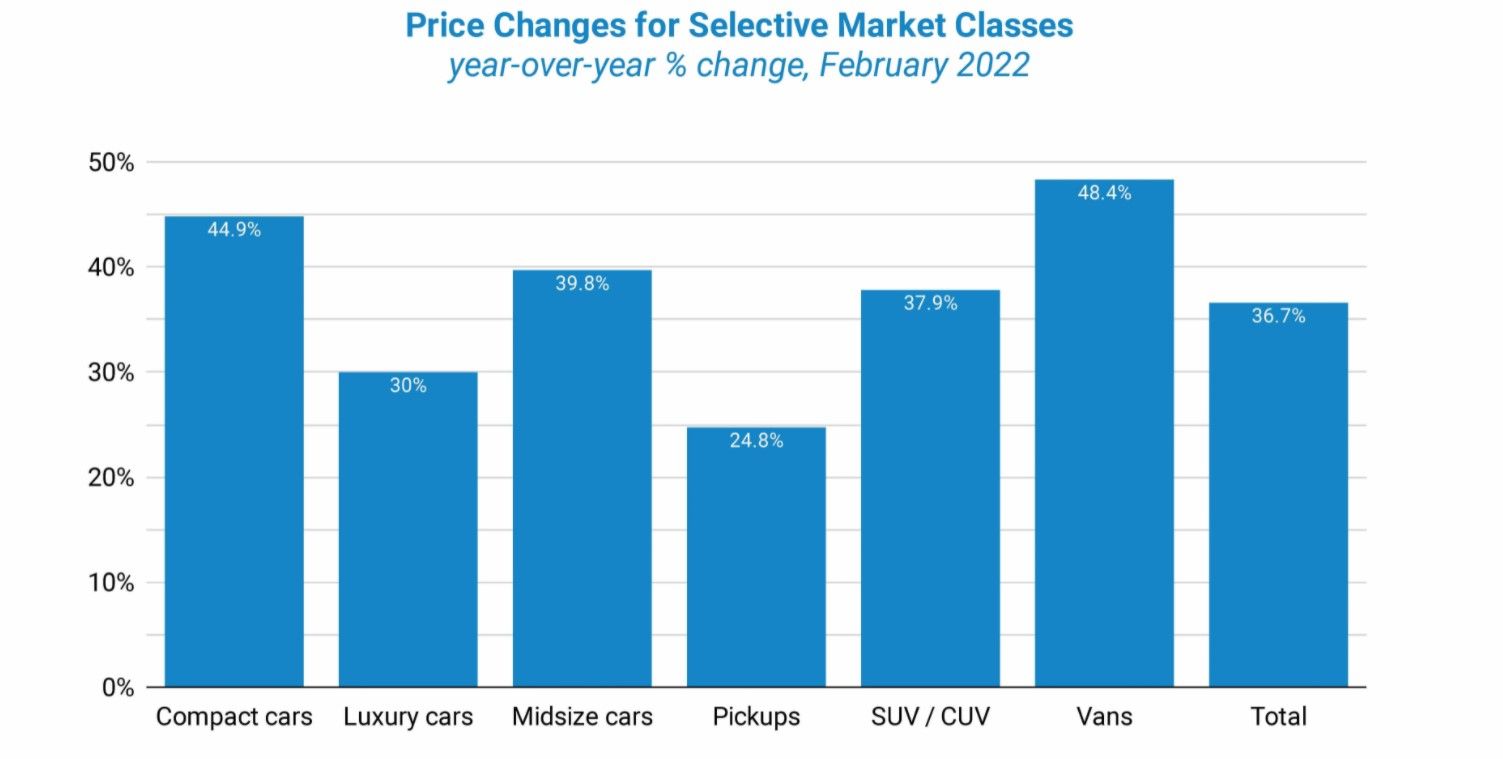

All major market segments saw seasonally adjusted prices that were higher than a year earlier. But all the segments also witnessed price declines compared to the previous month. Vans had the largest year-over-year increase in prices, followed by compact cars. In comparison, pickups, luxury cars, and sports cars lagged the overall market in price appreciation.

Prices may decline further if the inventory of used cars increases. According to Fox's usage of vAuto data, the day's supply of used retail vehicles was at 58 days on January 30, 2022. That is higher than the 44 days supply recorded at the end of January 2021. The supply of retail used cars did go down to 55 days by mid-February, but that is still higher than the 48 days supply seen in February 2021.

The supply of used cars is growing just as the market is entering the traditionally strong Spring selling season. Tax refund checks could stimulate sales, but economic and geopolitical conditions could put a damper on them. Furthermore, the demand for used cars is often aligned with the supply of new cars, which is still in a state of uncertainty.